Our Portfolio Optimization Models

Max Sharpe Ratio Portfolio

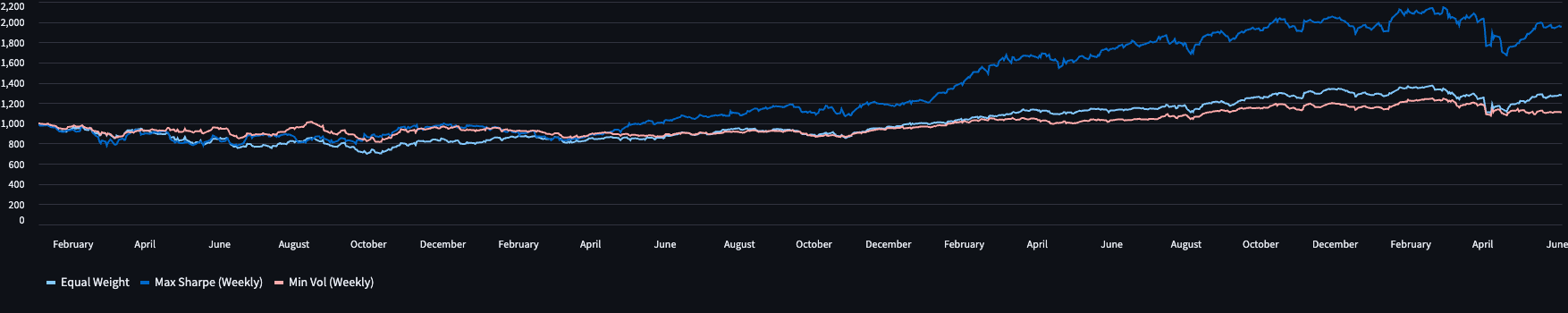

The maximum Sharpe ratio portfolio, also known as the tangency portfolio, is designed to provide the highest possible return per unit of risk by maximizing the Sharpe ratio. This strategy uses historical returns and asset correlations to determine the optimal allocation that balances expected return against volatility. It is commonly used by professional investors who seek to optimize performance while maintaining efficient risk management. The portfolio assumes the presence of a risk-free asset and aims to find the portfolio that lies tangent to the efficient frontier, offering the most favorable trade-off between risk and return.

Minimum Volatility Portfolio

The minimum volatility portfolio, or minimum variance portfolio, focuses on minimizing overall portfolio volatility regardless of the expected returns. It allocates investments in a way that reduces the total fluctuation in portfolio value over time, often favoring assets that have low correlation with one another. This approach is suitable for investors who are highly risk-averse and prioritize capital preservation over aggressive growth. It is especially useful during periods of market stress or uncertainty, as it aims to provide more stable performance with reduced drawdowns.